Acting as a catalyst for rapid digital development, the COVID-19 pandemic has been a boon for investment in and adoption of artificial intelligence (AI) technologies across industries. In the financial sector, advancing AI solutions have the potential to add colossal value for both banking institutions and their customers – and we’re already seeing some of the positive effects.

Digital-centric fintechs and incumbent firms alike have much to gain from implementing AI solutions, from cutting operational costs to mitigating risks to delivering better customer service. In fact, these technologies are likely to be a crucial ingredient for success in the future financial services market.

Let’s dive deeper into the current state of AI adoption in this ecosystem, developments in the works, and advantages companies can realize by executing a well-planned AI roadmap.

The Financial Impact of AI Applications in Finance

According to International Data Corporation (IDC) predictions, the amount spent globally on AI technologies will rise from $85.3 billion in 2021 to $204 billion by 2025. This amounts to a CAGR of 24.5%.

As for the global market for AI in fintech, it was valued at approximately $7.91 billion in 2020 and is projected to increase to $26.67 billion by 2026, according to a Mordor Intelligence overview. Between 2021 and 2026, the market is expected to register a CAGR of 23.17%. Along the way, as per McKinsey estimates, AI may deliver up to $1 trillion of added value annually in the global banking sphere as more firms move to scale these technologies.

Mordor Intelligence cited process automation as one of the most prominent drivers of AI adoption across financial organizations, with cognitive process automation set to automate even more complex tasks using advanced AI techniques like machine learning. In light of recent trends, challenges, and research, the IDC has predicted that a large percentage of upcoming banking industry AI investment will go towards risk reduction through automated threat intelligence and fraud analysis applications.

AI’s Promise for Financial Services + Trends to Watch in 2022

As the market forecasts clearly demonstrate, key players in the financial industry are optimistic about the value that AI-driven technologies can bring for business growth and optimization. With ever-increasing computational power and correspondingly huge amounts of data available to be processed with it, AI is being applied in imaginative ways by both incumbent banks and new entrants.

In McKinsey’s 2019 Global AI Survey, nearly 60 percent of financial services sector respondents indicated that they had already embedded at least one AI technology, such as robotic process automation (RPA), to perform structured operational tasks or machine learning techniques to detect cybersecurity risks.

In 2022 and the years to follow, increased funding for disruptive AI technologies is expected to provide a gateway for these tools to become more mainstream across more niches in finance. Here are some of the major financial services AI trends garnering a great deal of attention in the sector.

Automating Key Processes & Mitigating Risks

According to Gartner’s research, around 80% of finance leaders have implemented or are planning to implement RPA. Adoption of this technology is ramping up thanks to the promise it holds for improving efficiency, productivity, and accuracy through automation of financial processes.

When paired with other intelligent automation tools, RPA can help banks and other financial institutions minimize human errors, thus saving time and labor while managing security risks. According to research by the accounting firm KPMG, the use of RPA for routine tasks such as verifying customer information and creating monthly statements can slash costs for financial services firms by up to 75%.

One key process that can be automated with AI is bookkeeping. As a case in point, Wizeline helped TaxLab develop ThynkBooks, a platform that downloads, analyzes, and sorts transactions and helps companies complete their bookkeeping requirements. The solution has been proven to help increase efficiency for SMBs, reducing the time spent completing tax forms from an average of 14 hours to 20 minutes with a 92% accuracy rate in correctly classifying transactions.

Another example here is in the world of financial data used by investment professionals. For one financial services client, Wizeline developed an automated data pipeline for migrating proprietary databases to AWS DocumentDB, facilitating database management and integration with other services and technologies as well as expediting the data acceleration process. The pipeline runs daily to migrate new data for each database: roughly 15 GB of data per DB are migrated, transformed, and validated in approximately 25 minutes.

Facilitating the Shift from In-Person to Digital Banking

Even before the dawn of the COVID-19 pandemic, the mass transition from in-person to digital banking had already begun. Now more than ever, AI is being used to help banks give their customers secure and intuitive access to all the services they need, without visiting a physical branch.

In many scenarios, AI-powered chatbots can effectively assume the role of a helpful bank teller or customer service agent, helping customers find answers to their inquiries or even opening a new account. When needed, these always-available bots can forward issues to the appropriate department to be handled ASAP by customer service personnel.

Juniper Research estimated that the adoption of chatbots could save the healthcare, banking, and retail sectors $11 billion annually by 2023, mostly by saving 2.5 billion hours of human labor. While they haven’t been widely implemented quite yet, increased deployment of chatbots across financial services and other industries feels inevitable in 2022, given their potential to drive cost-curbing and efficiency-enhancing benefits.

At Wizeline, we’re no stranger to chatbots, including ones that are enabled through a conversational UI. We developed Wizebank to work via Amazon Alexa to answer banking customers’ general inquiries, provide on-demand customer service, and offer a concierge service to VIPs.

Improving the Customer Experience

Even as face-to-face banking wanes in favor of digital experiences, maintaining a strong relationship with customers is still just as essential. AI is helping banks cater to individual account holders with personalized app login features like facial recognition and voice command.

Additionally, AI is helping banks analyze their customers’ behavior and data in order to tailor marketing in a manner more likely to appeal to their unique wants and needs. With insights into what services certain customers may be looking for next, customer service representatives will be better equipped to delight them instead of simply trying to sell general services indiscriminately, a tactic that has often proven to be ineffective in the past.

Advancing Predictive Analytics & Automated Fraud Detection

Predictive analytics is used to determine the likelihood of future outcomes based on a set of data. In the financial sector, harnessing the power of data and predictive analytics can be highly valuable for numerous applications, from fraud detection to revenue and stock price forecasting.

On the horizon, we can expect to see credit card companies take advantage of automated machine learning software and advanced predictive analytics to decrease false positives in their fraud detection workflows, thus saving customer inconvenience and amplifying profitability.

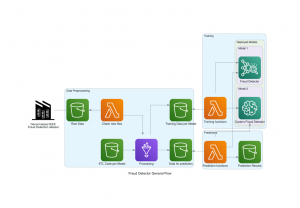

Machine learning-driven fraud detection process architecture

At Wizeline, we’ve developed a Fraud Detection Proof-of-Concept (PoC) that was designed to detect fraudulent activity via machine learning. Our approach aims to create and deploy a variety of models in a multi-cloud environment through the implementation of an automated MLOps process. We used three datasets to train the models:

-

- Dataset 1: A simulated credit card dataset containing legitimate and fraudulent transactions covering the credit cards of 1,000 customers with a pool of 800 merchants.

- Dataset 2: This dataset presents transactions that occurred in two days, where we have 492 frauds out of 216,94 transactions. The dataset is highly unbalanced, with the positive class (frauds) accounting for 0.172% of all transactions.

- Dataset 3: An additional set of two files with 20,000 transactions each.

In order to validate the models, we deployed a custom model created by our data scientists in SageMaker and a standard model on AWS Fraud Detector. We compared the outcomes of the two models to validate them both. Thanks to this training and validation process, the PoC identifies likely fraudulent transactions within any new dataset submitted to the model.

How Can Companies Leverage AI to Compete in the Financial World?

The trends listed above are just the beginning of how AI can and likely will be used to forge future improvements in the finance industry. So, it’s no wonder that interest and exploration into these technologies is surging.

With AI-fueled solutions gaining traction in the financial world, many big-tech leaders have scoped out the sector as the ideal place for their next endeavors. Meanwhile, incumbent banks have largely remained limited to applying AI for select use cases and failed to scale these technologies as of yet.

In order to remain competitive in the midst of increasing demand for highly digitized banking, financial services firms should become “AI-first” institutions, suggests McKinsey. This means drawing up a clear and detailed plan to strategically adopt AI technologies across their operations and lifecycle.

Companies looking to thrive in the sphere stand to benefit by taking cues from financial industry pioneers using AI technologies to optimize their service models, such as:

-

- Block (formerly Square): This well-known financial services and digital payments fintech company relies on conversational AI to power its virtual assistant. Block has achieved impressive operational efficiency improvements as a result, with 75% of customer questions handled by the virtual assistant, plus a 10% reduction in no-shows from potential customers at appointments with sales teams.

- Cleo: Created by a London-based startup, Cleo is an innovative money management chatbot that integrates with Facebook Messenger and is also available as an app. With AI as the backbone, this comprehensive solution allows customers to track their spending and generates personalized financial insights based on their bank data.

- BNY Mellon: As a leading provider of cross-border payment services, BNY Mellon processes more than $1 trillion on a daily basis. So, it’s crucial for the banking company to have sophisticated systems in place to detect fraud and preserve their customers’ data privacy. The firm cleverly applied machine learning and AI models on more than 100 million data samples to improve fraud prediction accuracy levels by 20%, all while safeguarding the confidentiality of the training data.

To fulfill customers’ growing expectations and demand for a personalized, seamless, and secure on-the-go banking experience, financial services firms will need to enter the AI-powered digital era by implementing innovative solutions like the examples above.

Execute Innovation with Industry-Leading Financial Technology Solutions from Wizeline

So there you have it: our complete rundown of AI’s financial impact in the industry, the major financial services AI trends to look out for in 2022, and key examples of how Wizeline can help.

If you’re ready to accelerate your company’s digital transformation and adoption of AI by mobilizing sophisticated natural language processing, machine learning, conversational AI, or RPA, you can count on Wizeline to deliver the latest AI technology solutions, expertly tailored to your business needs and goals.

Whether you are a new player or a well-established organization in the financial services sector, our teams can help your business build and deploy products and platforms to optimize resource utilization, improve operational efficiency, and derive meaningful insights from your data.

We believe in the power of automation to lead us to a brighter future while making businesses run smarter. To learn more about how Wizeline delivers customized, scalable data platforms and AI tools, download our guide to AI technologies and connect with us today at consulting@wizeline.com to start the conversation.