*updated in January 2023*

Cloud computing has revolutionized IT in the last decade, with over 94% of enterprises currently leveraging the benefits of cloud computing for some part of their business. In 2023, we can expect to see companies continuing to leverage cloud services to access innovative technologies and propel their business operations. On-premise IT is being replaced with cloud-based solutions, making flexible work arrangements possible in our globalized world. Migrating to a cloud environment can improve a business’ reliability and scalability while sometimes saving money on IT overhead by reducing the number of in-house data centers and infrastructure. Some organizations are also implementing a hybrid cloud or multicloud approach to further capitalize on these benefits.

Source: 5 Cloud & DevOps Trends to Fuel Your Tech Roadmap in 2023 (Wizeline)

As we look toward the future, the question is no longer whether you should move to the cloud; rather, who should you select as your cloud provider when you do, and what is the best way to optimize your current strategy? There are dozens of cloud providers to choose from, but in this blog, we’ll analyze the top three cloud providers from a market-share perspective to see who’s leading the way.

Clash of the Titans: Amazon vs. Google vs. Microsoft

The race to become the market-share leader in the public cloud computing industry has remained relatively unchanged in the last few years. Industry leaders are continuously expanding their reach, improving products, and adding to their service offerings to differentiate themselves in a highly competitive market forecast by Gartner to reach $591.8 billion USD in 2023.

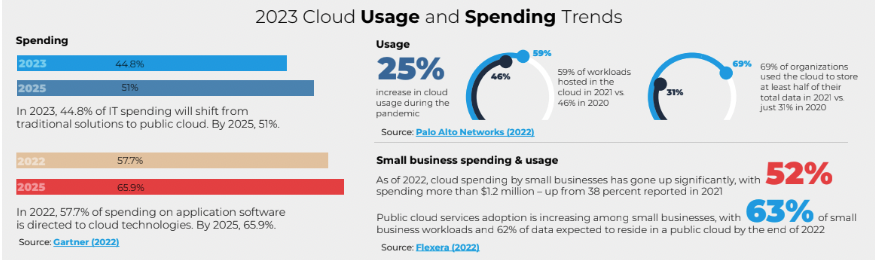

The market’s growth was accelerated in 2020 with the onset of COVID-19, which resulted in many companies shifting to a work-from-home environment and adapting to new business models. Keeping in line with the pandemic trend, total revenue and IT spending continue to move from traditional solutions to cloud solutions rapidly. This unprecedented growth is not expected to subside soon and poses an excellent opportunity for cloud computing providers to gain market share and increase revenue as adoption and demand grow.

However, in the face of inflationary pressure, possible economic downturns, and other factors, there is a chance that cloud spending at some organizations could decrease in 2023 if IT budgets are cut. Even so, cloud migration is likely to continue at a steady pace overall as companies seek to modernize their IT in the interest of long-term cost optimization, risk minimization, and other benefits to be gained through a well-planned cloud adoption strategy.

Sources: Gartner (2022) and Flexera (2022)

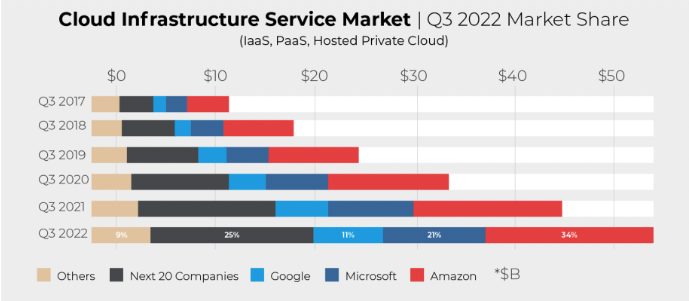

As of Q3 2022, three well-known tech giants – AWS, Azure, and GCP – continue to dominate the public cloud market, capturing a collective 66%, according to Synergy Research Group. AWS leads the pack with more market share than its two largest competitors combined, holding 34% as of Q3 2022. In 2021, the company continued to outperform analysts’ predictions with its accelerated growth in the marketplace – generating close to $18 billion USD in Q4 of 2021 and resulting in a 39.5% year-over-year increase. However, AWS’s Q3 2022 sales of $20.5 billion USD fell short of the projection for the quarter, amounting to 27% year-over-year revenue growth – its lowest since 2014. Organizations’ efforts to cut costs amidst rising inflation and economic uncertainty could help to explain this setback.

Source: Synergy Research Group (2022)

Trailing behind AWS is Microsoft Azure, holding a steady 21% market share in 2022. Microsoft’s cloud service has seen the quickest growth in market share since 2017 when it held 14% of the cloud market, and AWS held 32%. As Microsoft leverages its enterprise connections and decades-long reputation to push Azure, it continues to close the gap and put pressure on AWS. Flexera’s 2022 State of the Cloud Report revealed that in several areas, Azure usage has surpassed AWS usage for the first time. But, with Azure reporting its lowest revenue growth rate in two years at the end of 2022, there is evidence that the service provider is facing a similar set of obstacles as AWS.

Like Azure, GCP is increasing its market share year-over-year, from 10% in 2021 to 11% in 2022. However, GCP is the only provider in the top three known to operate at a financial loss – a consistent trend since its launch in 2008. Despite its operating loss, GCP claims to focus on a longer-term path to profitability by aggressively investing in its services. According to Forrester’s 2023 predictions, Google may acquire a reputable technology service provider in the coming year to increase enterprise presence and competitive potential for GCP.

Although Azure and GCP trail behind AWS in terms of market share and revenue, this doesn’t mean that AWS is the best option for all businesses. Each business has specific needs and goals, and each cloud provider has particular advantages and disadvantages that set them apart from the rest. This guide will compare and contrast the three largest cloud providers to aid you in making the best decision for your business.

How Wizeline Can Help

Migrating to the cloud and optimizing your workloads can have a tremendous impact on reducing your infrastructure costs, increasing development velocity, and accelerating product development.

Wizeline takes a vendor-agnostic approach to cloud solutions and provides custom cloud strategies tailored to each client’s business and technology needs. We have experience working with all three leading cloud providers and the resources and expertise necessary to make every partnership successful. Learn more about our cloud partnerships here or email us at consulting@wizeline.com.